The Impossible V2 Swap

Try the Impossible Finance V2 Swap now!

Try the Impossible Finance V2 Swap now!

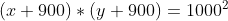

We at Impossible Finance are excited to unveil our v2 swap design that’s competitive with state-of-the-art AMM swap designs for stablecoin swaps. We use a novel bonding curve we term “xybk invariant”:

whereas b = boost, a tunable value during protocol operation. Essentially, what this invariant achieves is artificial inflation of Total Value Locked (TVL) in pools by a multiplier of boost times. For example, when x=token0balance=100, y=token1balance=100, boost=10, the pool has underlying assets of (100, 100), but exhibits the same swap slippage as a (1000, 1000) v2 uniswap pool:

Here are graphs showing how invariant shape and price slippage behavior changes compared to uniswap’s x* y=k — to sum it up, the higher the boost, the less price slippage there is throughout the curve:

Our swap provides:

Asymmetrical tuning

A novel feature our swap offers is asymmetrical tuning — the ability to provide different capital efficiencies for each side of the invariant curve. This is extremely useful for stablecoins with strong economics on 1 side of the peg.

For example, stablecoins with 24/7 trustless redemption for $1 of assets shouldn’t trade far under $1. For this stablecoin we might choose to provide 1000x capital efficiency when the peg breaks downwards and provide 50x capital efficiency when peg breaks upwards. Asymmetrical tuning allows us to tailor the most optimal balance between reward and impermanent loss for LPs.

This feature is provided by using two piecewise continuous xybk invariant curves joined at the midpoint, token0Balance = token1Balance = sqrtK:

2. Better gas efficiency

Our swap implementation of the xybk invariant is efficient, providing swaps as efficient as curve.finance based swaps + cheaper than uniswap v3 based swaps.

Comparing AMM Designs

It’s difficult to make precise capital efficiency comparisons with v3 uniswap as LPs choose their own capital efficiencies by choosing to LP over some price range. However, setting boost=4000 for xybk pools will allow our pools to match the capital efficiency of any uni v3 pool.

tl;dr: Our swap aims to provide LPs with better passive portfolio management through governance’s ability to precisely manage risk/reward based on market conditions. For users of swaps, we maintain very competitive slippage rates and swap fees.

We’re excited to launch our swap with:

Audits from Zokyo & peer reviews from Attic Lab regarding the security of our swap

A yieldfarm for LPs for IF-BUSD and IF-WBNB pools starting Friday, June 18th at 1:00pm (UTC) for 60 days

Also check our STAX to IF token Migration Guide

https://medium.com/impossiblefinance/the-impossible-migration-e31946376f2c

https://impossible.freshdesk.com/support/solutions/articles/80000651947-stax-to-if-migration

Follow us to stay up to date on Impossible happenings!

Website: https://impossible.finance/

Medium: https://medium.com/ImpossibleFinance

Telegram: https://t.me/ImpossibleFinance

GitHub: https://github.com/ImpossibleFinance

Twitter: https://twitter.com/ImpossibleFi

Discord: https://discord.gg/SyF3RzxQCZ